Down Payment Resource Donates $10,000 to Help an Atlantan Buy a Home this Holiday Season

Four times a year, we release a Homeownership Program Index (HPI) report where we delve into the data collected from our DOWN PAYMENT RESOURCE® database to unveil significant developments and emerging patterns in homebuyer assistance programs across the United States.

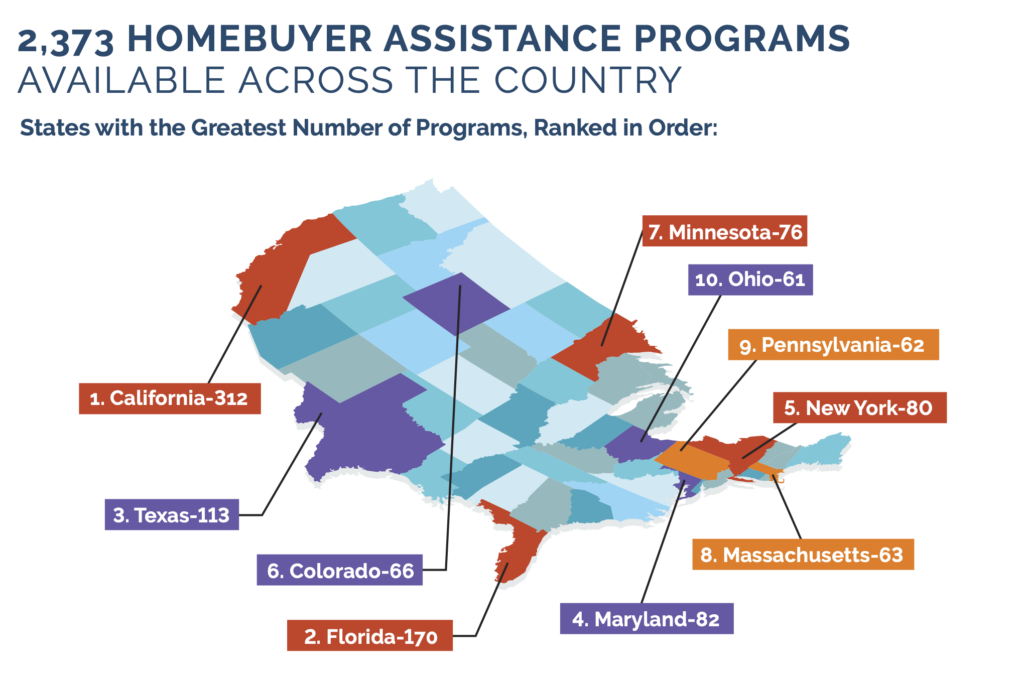

In our Q2 2023 HPI report, we have uncovered that for the second consecutive quarter, there has been a 0.5% increase in the availability of homebuyer assistance programs aimed at helping individuals finance their dream homes. This brings the total number of programs to an impressive 2,373. Moreover, as of July 3, 2023, a substantial 82.5% of these programs continue to offer funds to eligible homebuyers.

Here is a breakdown of the homebuyer assistance programs added last quarter:

The City of Madison’s Home-Buy The American Dream (HBAD) program provides up to $35,000 in down payment and closing cost assistance in the form of a deferred, silent second mortgage. This means the loan does not have to be repaid until certain conditions are met, such as selling the home or refinancing the loan. Because HBAD is also a shared appreciation program, once the loan is due, borrowers must repay the same percentage of the home value at sale as DPA borrowed at the time of purchase. While the program doesn’t limit home purchase price, borrower household income must be 80% HUD AMI or less.

Clay County SHIP Purchase Assistance Program provides people purchasing a home in Clay County, Fla. up to $15,000 in DPA in the form of a 30-year deferred, forgivable soft second. Provided all program conditions are met, borrowers do not have to repay the loan at the end of its term. Borrowing households may earn up to 140% of HUD AMI. Purchase price limits apply.

The City of Canton Down Payment Assistance Program provides up to $15,000 of DPA to people buying homes in Canton, Ga. The program takes the form of a five-year deferred, forgivable soft second mortgage, which means that borrowers do not have to make payments and the loan will be fully forgiven at the end of its term provided that requirements, such as maintaining owner occupancy, are met. Borrowers may earn up to 80% of HUD AMI. Purchase price limits are $333,000 for existing homes and $361,000 for new construction homes.

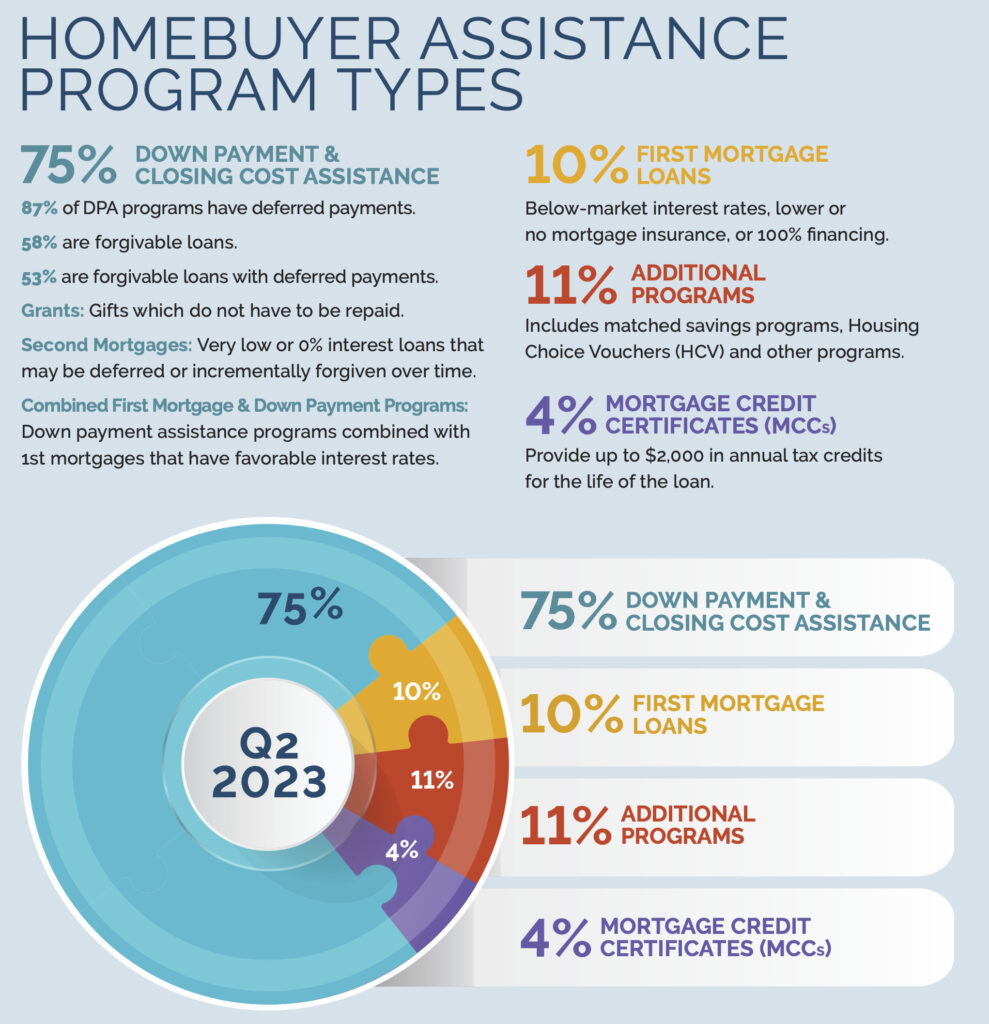

Overall, the breakdown of homebuyer assistance programs available by type was unchanged from the previous quarter.

A complete, state-by-state list of homebuyer assistance programs can be viewed here. Homebuyer assistance programs that waive the first-time homebuyer requirement for veterans and military personnel are tracked as two separate programs to report on dedicated assistance for military buyers.

You can also download the full infographic.

Down Payment Resource has crafted tools to help mortgage lenders, real estate agents and multiple listing services build relationships with homebuyers by connecting them with the homebuyer assistance they desire.

To explore the best option for your business, contact us.