Down Payment Resource Donates $10,000 to Help an Atlantan Buy a Home this Holiday Season

Saving for a down payment is a considerable barrier to homeownership. With rising home prices and interest rates and tight lending standards, the path to homeownership has become more challenging, especially for low-to-median-income borrowers and potential first-time homebuyers.

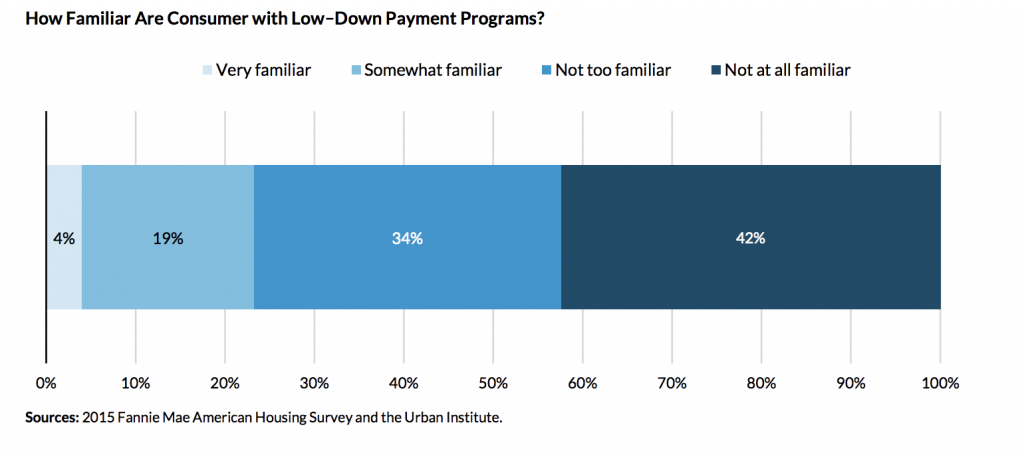

Yet most potential homebuyers are largely unaware that there are low– and no–down payment assistance programs available to help eligible borrowers secure an affordable down payment.

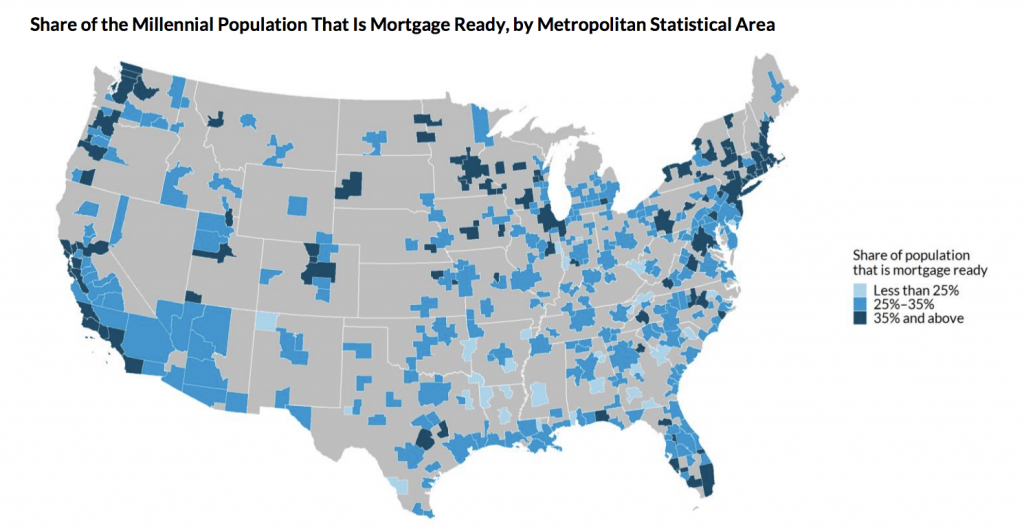

According to the updated and expanded Urban Institute Barriers to Homeownership report, commissioned by Down Payment Resource and Freddie Mac, there are about 21 million mortgage-ready renters under 40 in the 31 largest US cities.

In addition, most (about 88%) of the mortgage-ready millennials in the US earn enough to afford a typical house in their city.

Nationally, 2,527 programs provide grants and loans to make homeownership more affordable. It’s help that could make an impact. According to 2017 loan data in the 31 largest cities, about 789,000 homebuyers were eligible for an approximately of 6 programs, averaging $9,208 in down payment help. Down Payment Resource provided data critical for Urban Institute’s analysis in the report.

Borrower loan data shows that many consumers are not taking advantage of programs that could provide greater access to credit and homeownership. These programs’ benefits and costs are often not sought out, referred to, or communicated to potential homebuyers in a standardized way. The report recommends increasing the visibility of these programs and ensure mortgage borrowers know about available assistance.

The Urban Institute invites you to take the down payments quiz and find out how much you really know about down payments today.

The report includes an interactive map of the U.S. which allows you to compare 16 housing market factors, including homeownership programs, between states.

Never want to miss a post? For more useful down payment and home buying information, be sure to subscribe to our mailing list.