Down Payment Resource Donates $10,000 to Help an Atlantan Buy a Home this Holiday Season

Renters who want to buy in the future may feel like they have the cards stack against them.

We know the big issues: lack of starter home inventory, rising interest rates, student loan debt and the hurdle of saving for a down payment. In fact, according to the Zillow Housing Aspiration Report saving for a down payment was a barrier for 70 percent of renters, topping other hurdles such as job security and qualifying for a mortgage.

In a new Down Payment Resource survey of 750 future homebuyers, 85 percent said they were looking to buy a home in the next six months, but 63 percent did not have money saved for a down payment.

But saving even for a low down payment remains challenging. Sixty-five percent said they think it will be moderately to extremely difficult to save for a down payment.

Seventy-five percent of survey respondents said they were planning to save between 1 and 6 percent for down payment. The current median down payment for a first-time homebuyer is approximately 6 percent.

Today’s buyers are more eager to take homebuying education into their own hands.

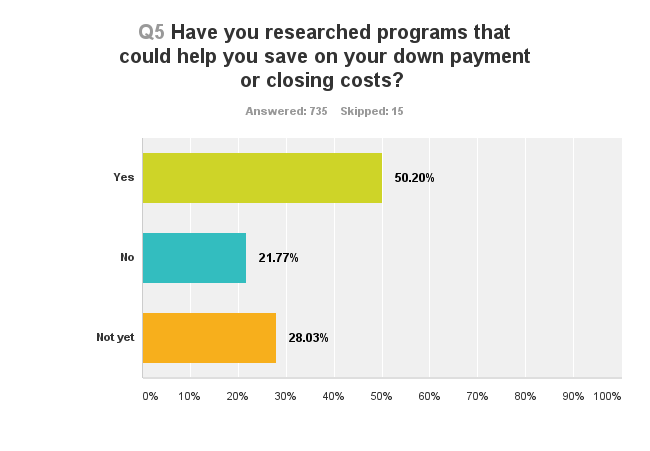

In fact, 72 percent of the respondents said they plan to complete an online or in-person homebuyer education course. And more than 50 percent have already researched down payment programs.

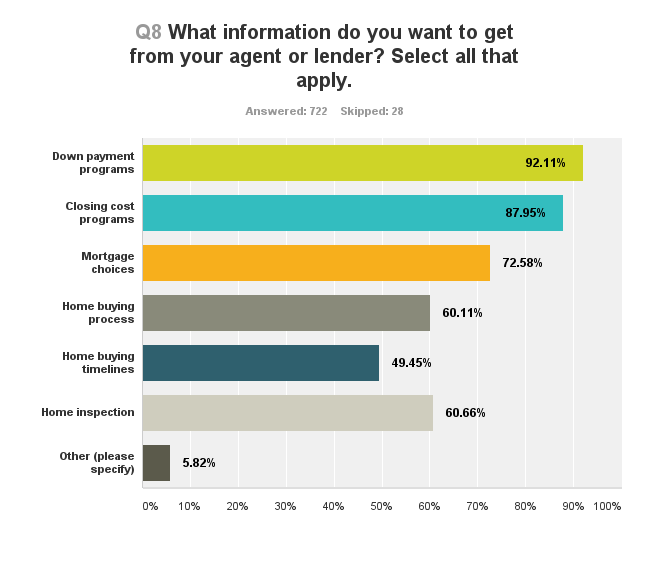

They also want valuable information from experts. A whopping 92 percent want information on down payment programs from their agent or lender. Would-be buyers are also interested in information about mortgage options and the homebuying process.

In a separate Down Payment Resource survey of 100 recent homebuyers, 63 percent said they wished their agent or lender had provided information about down payment programs during the homebuying process, ranking the higher than any other category. Only 18 percent of recent buyers said that their agent helped them learn about down payment options; 42 percent said their lender was helpful.

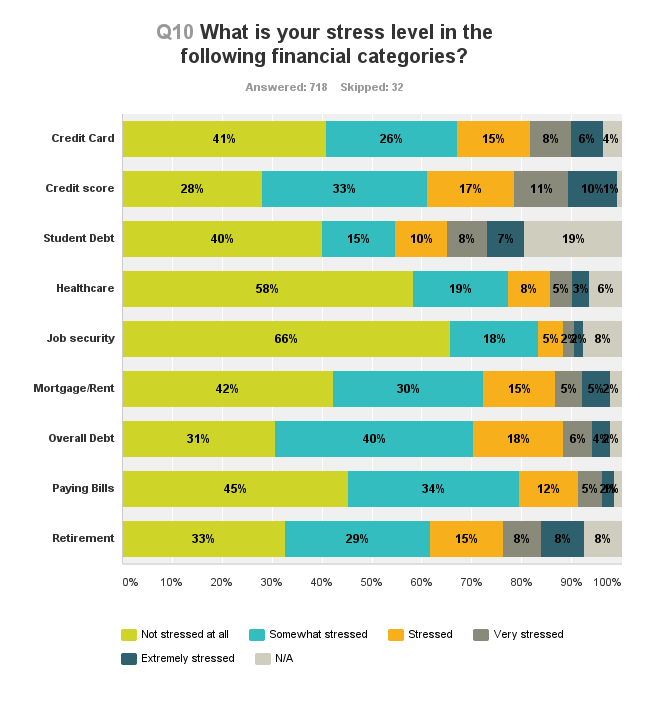

We also asked future homebuyers to indicate their stress level across nine key financial categories.

Respondents said credit score, retirement and credit card bills ranked highest (stressed, very stressed or extremely stressed) as a source of stress.

Future homebuyers were least stressed about their job and healthcare. And, 80 percent said they would or may be interested in using an online financial wellness tool to help improve their stress levels.

When it comes to new homebuyers, more information is better. They are eager to do their own research.

Agents and lenders are still gatekeepers in many cases. By opening the gate to information including down payment help and mortgage choices, you are building buyer trust.

Kris Rosser Schmitt, managing broker with the Barbier Agency, said “As agents, we are psychologists who sell houses. And first-time homebuyers are your best referral strategy…if you do it right. You are going to hand hold and educate more, but the ROI [return on investment] is huge. When you build trust with first-time homebuyers, you’ll gain stronger, more motivated leads.”

Future homebuyers said they wanted information on down payment and closing cost programs more than twice as often as the other categories.

As an industry we owe it to prospective homebuyers to help connect the dots and highlight the opportunities available.

Get all the survey highlights.

Future homebuyer survey respondents were mostly female (69 percent) and 55 percent were between the ages of 30-49. Forty-two percent were white, 36 percent were African American and 13 percent were Hispanic.Similarly, recent homebuyer respondents were mostly female (63 percent) and 52 percent were between the ages of 30-49.Forty-nine percent were white, 23 percent were African American and 16 percent were Hispanic. Seventy-three percent of the recent homebuyer respondents had purchased a house within the past 6 months.

Methodology: Down Payment Resource distributed an online survey to 11,000 consumers subscribed to its email communications. More than 7 percent, 850 total, clicked to complete the online survey: 750 identified themselves as a “future homebuyer” and completed the Future Homebuyer Survey and 100 identified themselves as a “recent homebuyer” and completed a separate Recent Homebuyer Survey. The surveys were completed in fourth quarter 2016.