Down Payment Resource Donates $10,000 to Help an Atlantan Buy a Home this Holiday Season

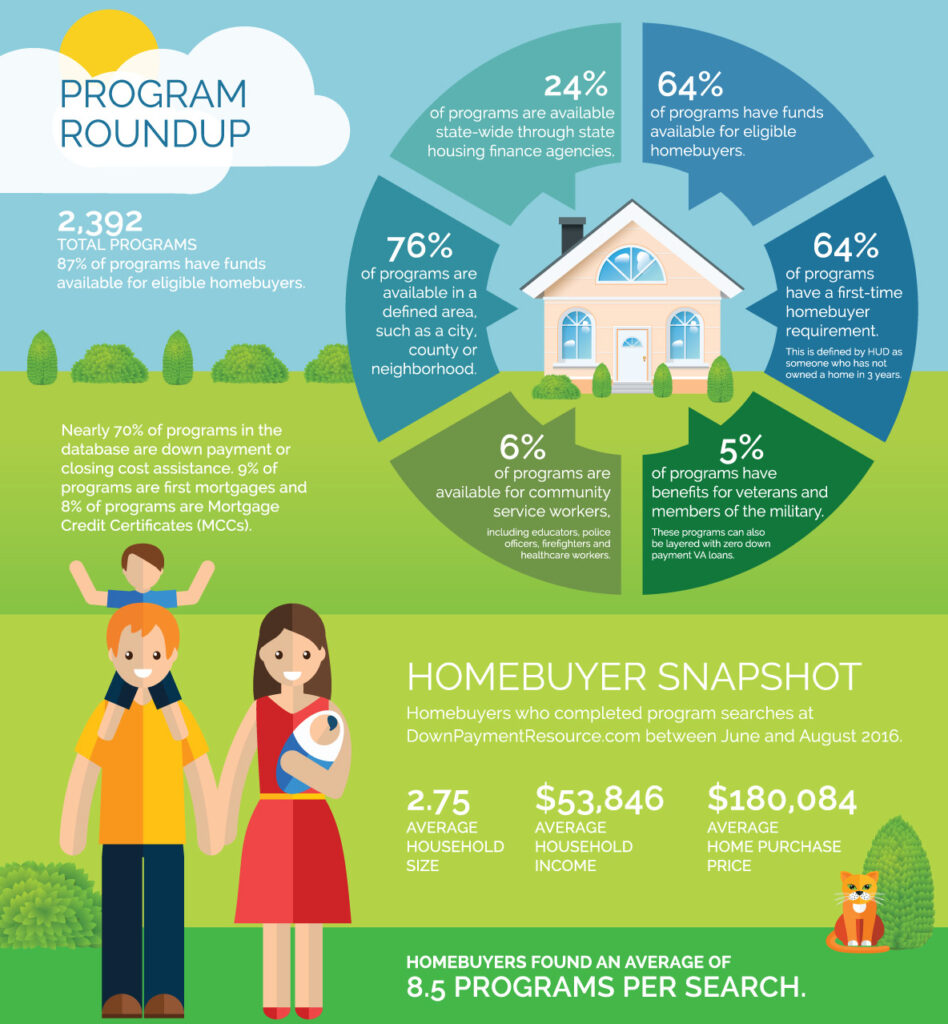

The Down Payment Resource Third Quarter 2016 Homeownership Program Index (HPI) found that the number of total homebuyer assistance programs decreased to 2,392, down 3 percent from the previous quarter (2,477). Nearly 88 percent (87.9%) of programs currently have funds available for eligible homebuyers, up 3 percent from the previous quarter.

The reduction of programs was primarily due to the expiration of more Neighborhood Stabilization Programs (NSP) offered by localities after the housing crisis. This was expected, as NSP funding came to a halt after round three (NSP3) in 2010. NSP programs helped numerous communities rehab, resell and redevelop high-foreclosure neighborhoods and offer very flexible income limits, purchase price limits and down payment help.

Moderate income workers in high cost markets, often opt out of homeownership due to the high home prices and market competition. In fact, the National Housing Conference’s “Paycheck to Paycheck” study found that none of the school occupations earned salaries that were high enough to guarantee either renting or owning a home in every metro area included. Plus, high school teachers earning median wages are only able to afford to buy a median-priced home in 130 out of the 210 metros analyzed.

More areas are launching programs to retain important community service workers. The HPI found that 6 percent of programs are available for community service workers, including educators, police officers, firefighters and healthcare workers.

Examples of programs include:

The HPI analyzed anonymous, aggregate data from approximately 33,500 homebuyers who successfully completed program searches at DownPaymentResource.com between June and August 2016. Homebuyers received customized results that fit their household characteristics and homeownership goals.

To qualify for a homeownership program, both the buyer and the property must meet certain criteria, which vary by program. These demographics suggest healthy incomes, growing families and a wide array of homeownership programs available to the next wave of prospective buyers.

“First-time homebuyers are eager to learn about down payment programs that can help them save on their home purchase,” said Chrane. “We’re convinced there is a groundswell of buyers ready, qualified and learning how best to proceed.”

Download the full press release.

Download the full infographic.