Down Payment Resource Donates $10,000 to Help an Atlantan Buy a Home this Holiday Season

The Down Payment Resource Fourth Quarter 2016 Homeownership Program Index (HPI) found that the number of total programs increased to 2,463, up 2.8 percent from the previous quarter. Approximately 87 percent (87.3%) of programs currently have funds available for eligible homebuyers, roughly unchanged from the previous quarter (87.9%).

Down payment challenges remain a key concern for first-time homebuyers. As many as one out of seven first-time buyers are tapping into their retirement funds to help with down payments, according to the most recent National Association of REALTORS® Profile of Home Buyers and Sellers. In fact, 14 percent of first-timers used either loans or disbursements from their 401k or IRA accounts for down payments in 2016. Yet only 3 percent are turning to sources like down payment assistance programs.

“Homeownership program availability and funding remain strong in 2017. With recent increases in the mortgage interest rate and no reduction of the FHA mortgage insurance premium, entry level homebuyers will need access to important down payment programs that can help them save,” said Rob Chrane, CEO of Down Payment Resource.

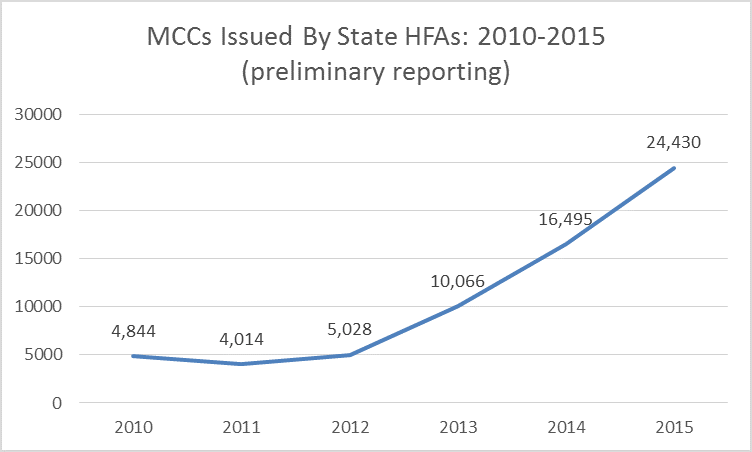

While the total number of programs remained consistent, the HPI saw an increase in Mortgage Credit Certificates (MCCs) across the country, representing more than 8 percent of all programs. Between 2010 and 2015, state housing finance agencies increased MCC issuances to homebuyers by more than 400 percent, according to preliminary data from National Council of State Housing Agencies (NCSHA).

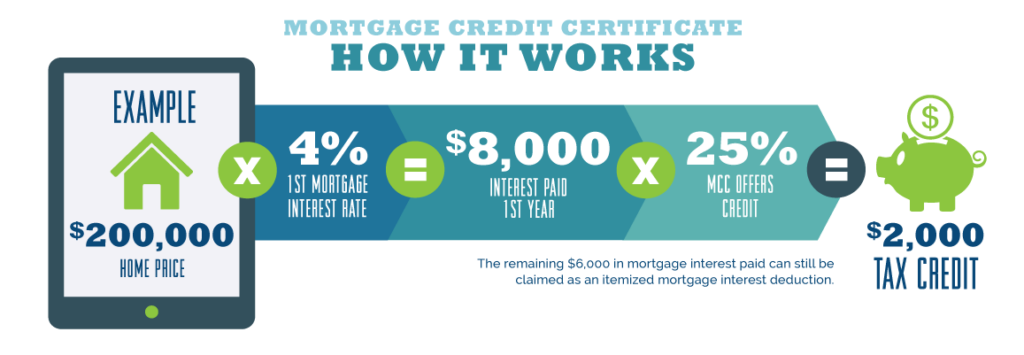

The MCC is a tax credit program that allows eligible homebuyers to claim a percentage of the mortgage interest they paid as a tax credit on their federal income tax return. The percentage of mortgage credit allowed varies depending on the state or local housing agency that issues the certificates, but the credit itself is capped at a maximum of $2,000 per year by the IRS. The buyer may continue to receive an annual tax credit for as long as they live in the home and retain the original mortgage.

“The mortgage interest rate tax deduction has long been a core homebuyer benefit, but most homebuyers are unaware of Mortgage Credit Certificates. This credit directly impacts a homebuyer’s bottom line by reducing their annual tax bill,” said Chrane. “We see more lenders adding MCCs to their product offerings.”

Qualifying homebuyers are permitted to use an MCC alongside another type of down payment assistance program, such as a grant or forgivable loan. These benefits can help secure the borrower’s ability to repay and lower their tax bill each year.

Download the full press release.

Download the full infographic.