Down Payment Resource Donates $10,000 to Help an Atlantan Buy a Home this Holiday Season

In honor of National Military Appreciation Month, our First Quarter 2017 Homeownership Program Index highlights the important programs available to veterans and members of the military.

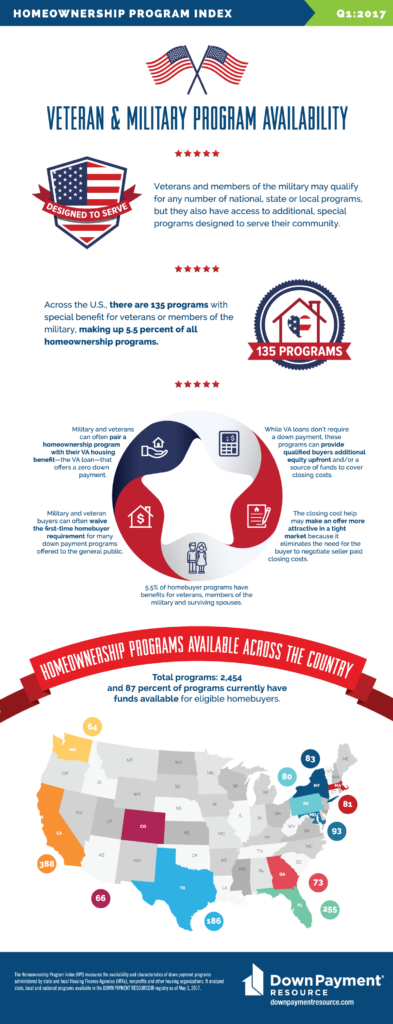

The number of total down payment programs decreased to 2,454, down by just nine programs from the previous quarter. Approximately 87 percent (87.2%) of programs currently have funds available for eligible homebuyers, unchanged from the previous quarter.

Across the U.S., there are 135 programs with special benefits for veterans or members of the military, making up 5.5 percent of all homeownership programs.

“There are many mortgage ready renters today, but they don’t know it. Often, homebuyers remain sidelined for years due to the down payment,” said Rob Chrane, CEO of Down Payment Resource. “Plus, veterans and members of the military may not know about additional homeownership benefits they can pair with their VA loan. After serving our country, it’s important we in turn support our veterans in achieving their dream of homeownership.”

Veterans and members of the military may qualify for any number of national, state or local programs, but they also have access to additional, special programs designed to serve their community. In addition, military and veterans can often pair a homeownership program with their VA housing benefit—the VA loan—that offers a zero down payment. Military and veteran buyers can often waive the first-time homebuyer requirement for many down payment programs offered to the general public.

While VA loans don’t require a down payment, these programs can provide qualified buyers additional equity upfront and/or a source of funds to cover closing costs. The closing cost help may make an offer more attractive in a tight market because it eliminates the need for the buyer to negotiate seller paid closing costs.

One nationally available program for veterans is the PenFed Foundation Dream Makers program, formed by the PenFed Credit Union in 2001. The program provides a two-for-one matching grant up to $5,000 for military personnel and veterans. It requires 3% down payment and an income no higher than 80% of the area median income in the county where the home is being purchased, but the grant from the Foundation can be used towards the down payment requirement. It does not have to be repaid.

“Since the Dream Makers inception, the PenFed Foundation has provided over $5 million in down payment assistance grants, supporting the purchase of a home by veterans and military personnel,” said Mark Smith, Director of Programs at the PenFed Foundation.

Local communities also offer special programs for veterans. The Atlanta Neighborhood Development Partnership (ANDP) offers a Veterans Program that provides newly renovated homes priced affordably as well as down payment assistance to qualified buyers. The assistance on a qualifying home ranges from $5,000 to $30,000 and there is no first-time homebuyer requirement.

The Florida Housing Finance Corporation offers a Florida First & Military Heroes Program for veterans and active duty military personnel. It provides qualifying buyers with a government (FHA, VA, USDA-RD) first mortgage loan at a reduced interest rate. Plus, veterans do not have to be first-time homebuyers.

In Phoenix, the Home in 5 Advantage program offers eligible buyers a 2.5% or 3.5% down payment/closing cost assistance grant and provides an additional 1% down payment assistance grant for qualified United States military personnel, veterans, first responders and teachers. The program allows household income of $88,340 and home prices of up to $300,000.

The Texas State Affordable Housing Corporation (TSAHC) Homes For Texas Heroes program provides veterans and other targeted community heroes a first mortgage along with a grant of 3% to 5% of the first loan amount for down payment and closing cost assistance. Available across the state, the program allows qualifying income up to 115% of the area median income in non-targeted areas and 120% to 140% in targeted areas. Maximum purchase price limits are by county and go up to more than $400,000 in targeted areas. Plus, veterans do not need to be first-time homebuyers.

Download the full First Quarter 2017 Homeownership Program Index press release.